Why Kentucky Business Insurance is Essential for Your Success

KY business insurance protects your company from financial losses due to accidents, lawsuits, property damage, and other unexpected events. Here’s what you need to know:

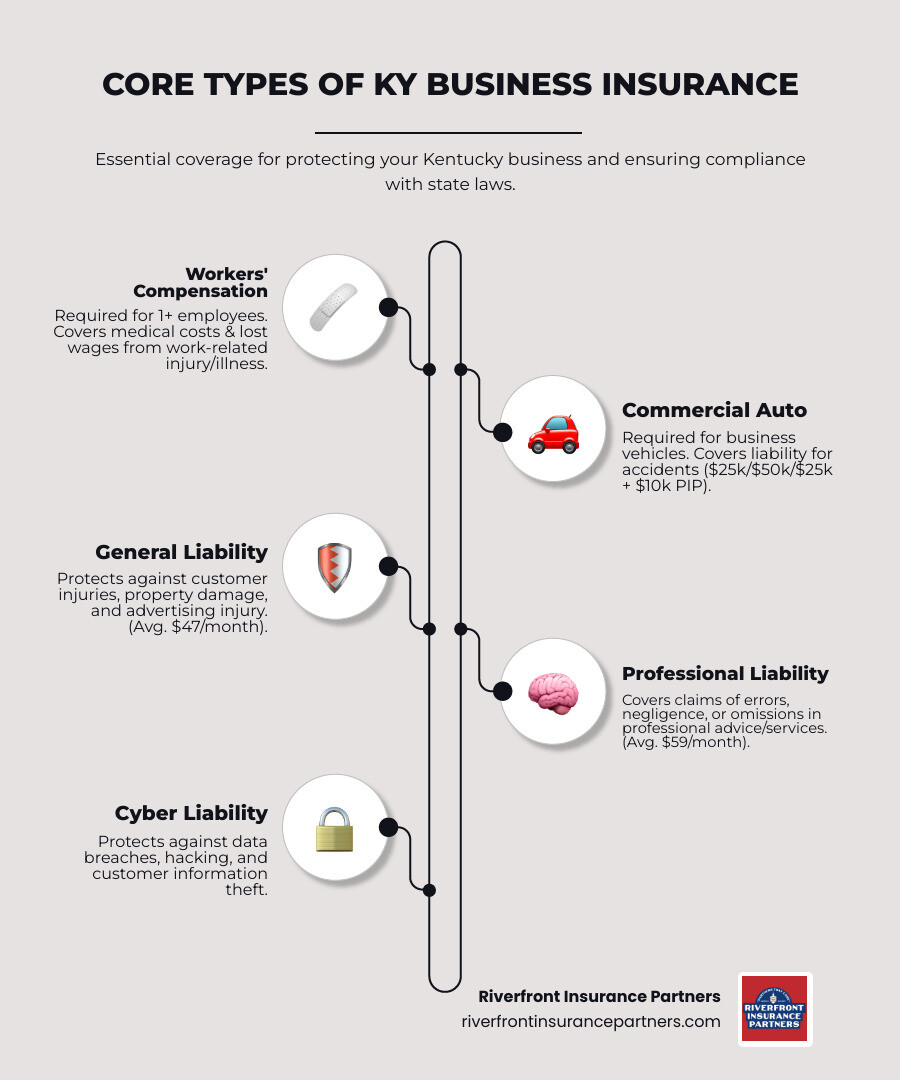

Mandatory Coverage in Kentucky:

- Workers’ Compensation – Required if you have one or more employees

- Commercial Auto Insurance – Required for all business-owned vehicles (minimum $25k/$50k/$25k + $10k PIP)

- Unemployment Insurance – Required for employers

Recommended Coverage:

- General Liability – Protects against customer injuries and property damage (avg. $47/month)

- Business Owner’s Policy (BOP) – Bundles property and liability coverage at a discount

- Professional Liability – Covers claims of errors or negligence (avg. $59/month)

- Cyber Liability – Protects against data breaches and cyber attacks

If you’re among Kentucky’s 363,000 small businesses employing over 706,000 people, you’re building something valuable. But that value needs protection.

One customer slip-and-fall. One employee injury. One data breach. Any of these can create financial stress that threatens everything you’ve built. Business insurance isn’t just about compliance with state law – it’s about protecting your livelihood and giving you peace of mind so you can focus on growth.

The challenge? Kentucky has specific insurance requirements that differ from other states, and choosing the wrong coverage (or not enough of it) can leave you exposed. The good news is that understanding your options doesn’t have to be complicated.

I’m Tyler Geiman, and I’ve helped businesses throughout Northern Kentucky and Greater Cincinnati secure the right ky business insurance coverage while typically saving them 20-25% annually. Whether you’re just starting out or looking to optimize your existing coverage, this guide will walk you through everything you need to know.

State-Mandated Business Insurance in Kentucky

Operating a business in the Bluegrass State comes with certain responsibilities, and some insurance policies aren’t just a good idea—they’re the law. Adhering to these mandatory requirements is crucial for legal compliance, protecting your employees, and safeguarding your business from significant financial liabilities and penalties. Ignoring these can lead to fines, stop-work orders, and even personal liability.

Workers’ Compensation Insurance

If your business in Kentucky has one or more employees, you are legally required to provide workers’ compensation insurance. This isn’t just a suggestion; it’s a state law established to protect your workforce.

What it Covers: Workers’ compensation is designed to provide benefits to employees who suffer job-related injuries or illnesses. This includes covering medical expenses, rehabilitation costs, and a portion of lost wages while they recover. For example, if an employee working at your Covington restaurant slips and breaks an arm, workers’ comp would cover their hospital bills and a percentage of their salary while they’re unable to work.

Protection for Employers: While it primarily benefits employees, workers’ compensation also offers a critical layer of protection for employers. It generally acts as a “sole remedy,” meaning that in exchange for providing these benefits, employees typically give up their right to sue their employer for negligence related to the injury. This can save your business from costly civil litigation, which is a significant financial risk.

Kentucky does not sponsor a state-run workers’ compensation program, so it is the employer’s responsibility to secure this insurance from a private carrier or to self-insure. You can verify the status of your business’s coverage using the Department of Workers’ Claims Insurance Coverage Look-up Tool. For more in-depth information, we recommend reviewing the resources available through the Kentucky Department of Workers’ Claims. To truly grasp the breadth of this coverage, exploring our guide on Understanding Workers’ Compensation Insurance is highly beneficial.

Commercial Auto Insurance

If your business owns or leases vehicles—whether it’s a delivery van for your Florence bakery, a service truck for your Newport plumbing business, or a car for client visits in Erlanger—these vehicles must be covered by commercial auto insurance. Even if employees use their personal vehicles for business purposes, you may need additional coverage like Hired and Non-Owned Auto insurance. Personal auto policies typically exclude accidents that occur during business operations.

Kentucky’s Minimum Requirements: The state of Kentucky mandates specific minimum liability limits for all vehicles, including those owned by businesses. These are:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $25,000 for property damage liability per accident

- $10,000 for personal injury protection (PIP)

Alternatively, a business owner can opt for a policy with a single limit of $60,000 and basic reparations benefits (PIP). It’s crucial to understand Kentucky’s minimum auto liability requirements to ensure your business complies. Trucking companies, for instance, may need additional coverage to meet federal and state regulations.

Commercial auto insurance protects your business financially in the event of an accident involving a business vehicle. This coverage can pay for medical expenses for injured parties, repair costs for damaged property, and legal defense fees if your business is sued.

Unemployment Insurance

As an employer in Kentucky, you are required to pay for unemployment insurance. This is a state tax that contributes to a fund providing temporary financial assistance to eligible workers who lose their jobs through no fault of their own.

Kentucky employers must register with the Office of Employment and Training (OET) to establish a state unemployment insurance account. The Kentucky Unemployment Insurance Employer Guide provides a comprehensive overview of employer obligations. This ensures that when unforeseen economic downturns or business changes occur, a safety net is in place for your former employees.

Key Recommended Policies for Your KY Business Insurance Portfolio

Beyond the mandatory policies, a robust ky business insurance portfolio includes additional coverages that shield your company from a wide array of common and specific risks. These policies are not legally required but are highly recommended to protect your assets, reputation, and future.

General Liability Insurance (GL)

Often considered foundational, General Liability (GL) insurance is crucial for nearly every business, regardless of size or industry. It protects your business from third-party claims of bodily injury, property damage, and personal or advertising injury.

What it Covers:

- Bodily Injury: If a customer slips and falls at your retail store in Florence, or is injured by a product you sell, GL can cover their medical expenses and legal fees if they sue.

- Property Damage: Should an employee accidentally damage a client’s property while on a job in Independence, GL can cover the repair or replacement costs.

- Personal and Advertising Injury: This covers claims like libel, slander, copyright infringement in advertising, or wrongful eviction.

The average cost for General Liability insurance in Kentucky is around $47 per month, a small price for significant protection against everyday risks. For a deeper dive into this vital coverage, explore our resources on Liability Insurance Protection.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) is a fantastic option for many small to medium-sized businesses in Kentucky. It intelligently bundles several key coverages into one convenient and often more affordable package, saving you money compared to purchasing individual policies.

What it Bundles: A typical BOP combines:

- General Liability Insurance: As described above, protecting against third-party claims.

- Commercial Property Insurance: Covers your business’s physical assets, including buildings (if you own them), equipment, inventory, and furniture, against perils like fire, theft, and vandalism.

- Business Interruption Insurance: Also known as business income insurance, this covers lost income and ongoing operating expenses (like payroll and rent) if your business is forced to temporarily close due to a covered event (e.g., a fire or storm damage).

The key difference between a BOP and standalone policies like General Liability or Workers’ Compensation is the bundling aspect. While General Liability focuses solely on third-party claims and Workers’ Compensation covers employee injuries, a BOP provides a comprehensive shield for both your liability and your physical property, often at a discounted rate. It’s ideal for businesses with a physical location, equipment, inventory, and regular customer interaction, such as a bakery in Fort Thomas or a boutique in Covington.

Professional Liability (E&O)

If your business provides advice, services, or expertise—such as an IT consultant in Erlanger, an accountant in Florence, or a marketing agency in Newport—Professional Liability insurance, also known as Errors and Omissions (E&O) insurance, is indispensable.

What it Covers: E&O protects your business from claims of negligence, errors, or omissions in the professional services you provide. Even if you’re meticulous, mistakes can happen, or a client might simply be dissatisfied with an outcome and allege a professional failing. This policy can cover legal defense costs, settlements, or judgments. For example, if a client sues your consulting firm claiming your advice led to financial losses, E&O would step in. It also covers claims arising from missed deadlines or contractual breaches related to your services.

The average cost for Professional Liability/E&O insurance in Kentucky is around $59 per month. This specialized coverage is distinct from General Liability, which covers physical injury or property damage, whereas E&O covers financial losses resulting from professional mistakes. Our guide, Protect Your Assets with Comprehensive Liability Insurance in Covington, KY by Riverfront Insurance Partners, offers further insights into liability protection.

Cyber Liability Insurance

No business is immune to cyber threats. Cyber Liability insurance is increasingly crucial for businesses operating in Kentucky, especially those that store or manage sensitive customer data.

The Growing Threat: Hackers are three times more likely to target small businesses than larger corporations, as they often have fewer resources to combat a threat. A data breach can be devastating, leading to financial losses, reputational damage, and legal headaches. Kentucky’s data breach laws require businesses to report security breaches to affected residents, and the costs associated with these notifications, forensic investigations, legal fees, and potential fines can escalate quickly.

What it Covers: Cyber Liability insurance helps your business survive data breaches and cyberattacks by covering:

- Notification Costs: The expense of informing affected customers about a breach.

- Forensic Investigation: Costs to determine the cause and extent of the breach.

- Legal Fees and Fines: Expenses related to regulatory compliance, lawsuits, and penalties.

- Reputation Management: Costs to restore your business’s standing after an incident.

Even if you run a small shop in Taylor Mill, if you process credit card payments or maintain customer contact lists, you have a cyber risk. This coverage is essential for protecting against the unique digital threats of our time.

Understanding Costs and Determining Your Coverage Needs

Navigating ky business insurance can feel like trying to solve a puzzle, especially when it comes to costs and coverage levels. Our goal is to help you understand how premiums are calculated and how to determine the right amount of protection for your unique business.

What Factors Influence Your Insurance Premiums?

The cost of your business insurance in Kentucky isn’t a one-size-fits-all figure. Several factors come into play, shaping your premiums:

- Industry and Risk Level: A roofing contractor in Burlington will inherently face higher risks (and thus higher premiums) than a graphic designer in Oakbrook. Businesses in high-risk industries, like construction or manufacturing, will typically pay more.

- Business Location: Geographic location, including local crime rates, weather patterns (e.g., tornado risk, flood zones), and even the specific fire district, can influence property and liability rates.

- Number of Employees: More employees mean higher payrolls and potentially more exposure to workers’ compensation claims, which directly impacts your premiums.

- Annual Revenue: Generally, businesses with higher revenues may have more assets to protect and potentially higher liability exposure, influencing costs.

- Claims History: A history of previous insurance claims can indicate higher future risk, leading to increased premiums. Maintaining a clean claims record can help keep your costs down.

- Coverage Limits and Deductibles: The higher your chosen coverage limits (the maximum amount an insurer will pay), the higher your premium. Conversely, choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium.

For instance, the average cost for General Liability insurance in Kentucky is $47 per month, while Workers’ Compensation averages $49 per month, and Professional Liability/E&O is about $59 per month. These are averages, and your specific costs will depend on your unique business profile.

How to Determine the Right Amount of KY Business Insurance Coverage

Figuring out the “right” amount of coverage is a critical step in building a resilient business. It’s about balancing comprehensive protection with affordability.

- Assess Your Specific Risks: Start by identifying the unique risks your business faces. What kind of accidents could happen? What assets could be damaged? What professional mistakes could occur? Are you a business that delivers goods in Newport? Do you have customers visiting your store in Covington? A thorough risk assessment is your first line of defense.

- Review Contract Requirements: Many contracts, especially with clients, landlords, or lenders, will stipulate minimum insurance coverage requirements. Ensure your policies meet these obligations. For example, a commercial lease in Florence might require a certain amount of General Liability coverage.

- Consider Industry Standards: Research what other businesses in your industry typically carry. Industry associations or peers can often provide valuable insights into common coverage levels.

- Balance Coverage with Budget: We understand that every dollar counts. Work with an experienced insurance professional to find the sweet spot between adequate protection and a manageable budget. Sometimes, opting for a Business Owner’s Policy can provide excellent bundled coverage at a reduced rate.

- Regularly Review Your Policies: Your business evolves, and so should your insurance. Changes like hiring new employees, expanding services, purchasing new equipment, or moving to a larger location in Erlanger all warrant a review of your coverage. We always recommend you Regularly Review Insurance Policies to ensure they still meet your needs.

Frequently Asked Questions about Kentucky Business Insurance

We get a lot of great questions from Kentucky business owners. Here are some of the most common ones to help you steer your insurance journey.

What are the legal penalties for not having workers’ compensation in Kentucky?

Not having the legally required workers’ compensation insurance in Kentucky can lead to severe consequences for your business. The legal implications are significant and can include:

- Fines: The state can impose substantial financial penalties for non-compliance.

- Stop-Work Orders: State authorities can issue an order to cease all business operations until proper coverage is obtained, leading to lost revenue and operational disruptions.

- Personal Liability: If an uninsured employee gets injured, the business owner could be held personally liable for all medical expenses, lost wages, and other benefits that workers’ compensation would normally cover. This can be financially devastating.

- Misdemeanor Charges: In some cases, failing to carry workers’ compensation can result in criminal misdemeanor charges.

- Inability to Defend Against Lawsuits: Without workers’ comp, your business loses the “sole remedy” protection, meaning injured employees could sue you directly for negligence, without the caps typically associated with workers’ compensation claims.

These penalties far outweigh the cost of a workers’ compensation policy, emphasizing why compliance is non-negotiable.

How does a Business Owner’s Policy (BOP) save money?

A Business Owner’s Policy (BOP) is a smart financial move for many small to medium-sized businesses because it offers a package discount. Instead of purchasing General Liability, Commercial Property, and Business Interruption insurance separately, a BOP bundles them, typically resulting in a lower overall premium.

Here’s a simplified look at how it might save you money:

| Policy Type | Estimated Individual Monthly Cost | Estimated Total Individual Monthly Cost | Estimated BOP Monthly Cost (Bundled) | Potential Monthly Savings |

|---|---|---|---|---|

| General Liability | $47 | |||

| Commercial Property | $50 | |||

| Business Interruption | $30 | |||

| Combined Total | $127 | $100 (Example) | $27 | |

| These are illustrative examples; actual costs vary. |

Beyond the direct cost savings, a BOP also offers simplified management. You deal with one policy, one renewal date, and often one point of contact for multiple coverages, streamlining your insurance process.

Do I need business insurance for my home-based business in Kentucky?

Yes, absolutely! While it might seem like your homeowner’s insurance would cover everything, it almost certainly doesn’t. Homeowner’s policies have significant limitations when it comes to business activities.

- Homeowner’s Policy Limitations: Standard homeowner’s insurance typically offers very little, if any, coverage for business equipment, inventory, or liability arising from business operations. If a client visits your home office in Alexandria and has a slip-and-fall accident, your homeowner’s policy would likely deny the claim, leaving you personally liable.

- Coverage for Business Equipment: If your valuable laptop, specialized tools, or inventory (even if stored in your garage in Hebron) are stolen or damaged, a homeowner’s policy might only offer minimal coverage, if any.

- Liability for Client Visits: Any clients visiting your home for business purposes create a liability exposure that your homeowner’s policy won’t cover.

- Professional Liability Needs: If your home-based business provides professional services (e.g., a freelance graphic designer in Covington), you’ll still need Professional Liability (E&O) insurance.

- Hired and Non-Owned Auto: If you use your personal vehicle for business deliveries or client meetings, your personal auto insurance may not cover accidents during business use. Hired and Non-Owned Auto insurance (often added to a General Liability policy) can bridge this gap.

Even if you don’t have clients visiting your home, a home-based business still needs protection for its assets and operations. A Business Owner’s Policy (BOP) or a combination of General Liability and Commercial Property insurance can often provide the necessary protection.

Finding Your Partner in Protection

Navigating the complex landscape of ky business insurance doesn’t have to be a solo journey. Finding the right insurance partner can make all the difference, providing you with the peace of mind to focus on what you do best—running your business.

We, Riverfront Insurance Partners, are a local agency deeply rooted in Covington, KY, and proudly serving businesses across Northern Kentucky, Greater Cincinnati, and surrounding areas like Florence, Newport, and Erlanger. We pride ourselves on offering comprehensive, personalized, and competitively priced insurance solutions custom to your specific needs.

Our local expertise means we understand the unique challenges and opportunities that businesses face in Kentucky. We’re here to help you:

- Understand State Resources: We can guide you to valuable state resources, such as the Kentucky Department of Insurance, to ensure you’re always informed and compliant.

- Personalized Service: We take the time to get to know your business, your risks, and your goals. This allows us to craft an insurance portfolio that truly protects your investment without unnecessary coverage. We’re not just selling policies; we’re building relationships.

- Community Focus: As a community-focused provider, we believe in quick responses and being there when you need us most. We want to see our local businesses thrive.

Don’t let the unknown risks threaten your hard work. Let us help you safeguard your business. Explore how we can Protect Your Business with Comprehensive Insurance Plans and allow us to be your trusted partner in achieving lasting security.